There are three givens when it comes to investing.

The first given: if you meet an investor who is looking to try something new, or is restless about their investments, it’s almost inevitable that they’ve recently endured some poor returns.

The second given: if you meet an investor who has no intention of changing a thing and is totally comfortable about their investments, it’s almost inevitable they’ve recently enjoyed a run of good returns.

The third given: investor one and investor two are certain to be the same person; their investment outlook only depends on the time when you meet them.

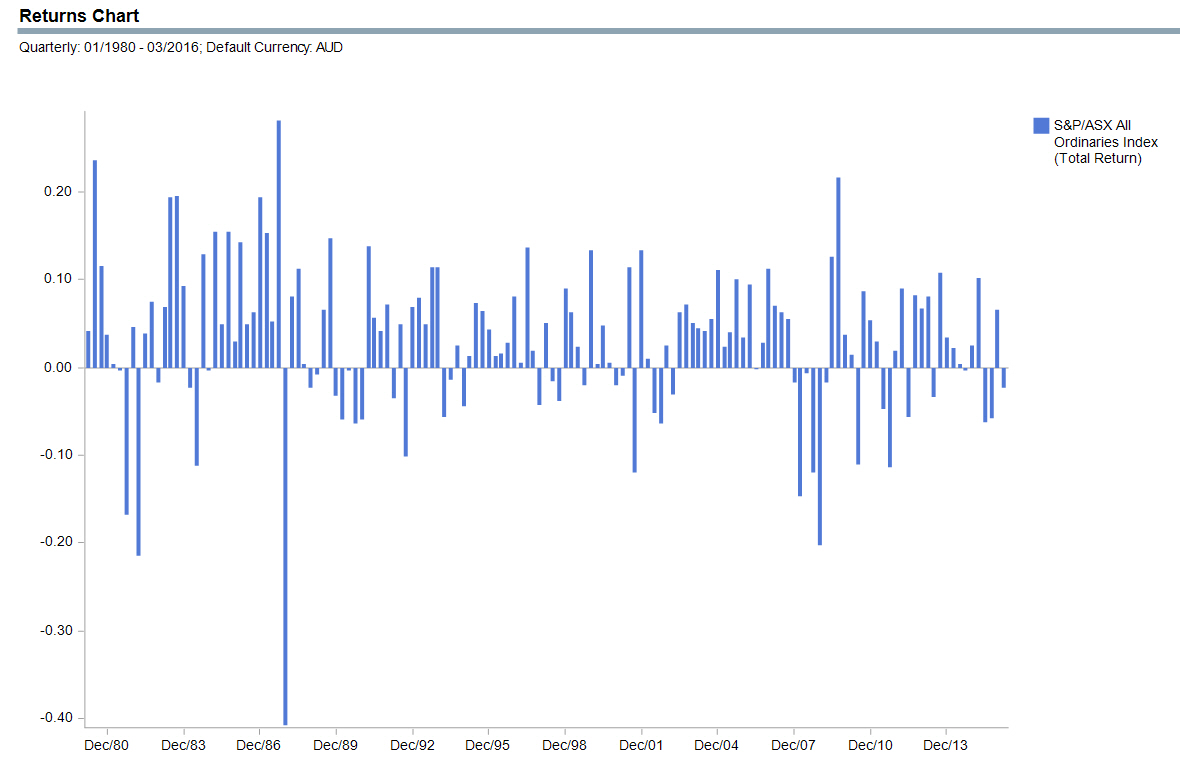

Recency bias tells us, that no matter how unlikely, we have a tendency to believe that the investment returns we’ve just enjoyed (or suffered) will continue into the future. Which is an interesting contradiction given the sharemarket’s reputation as being unpredictable and volatile.

Nothing makes an investor question their next move like poor returns and quite often those poor returns lead an investor to think they have to do something. It’s this feeling of “having to do something” that lead an investor to abandon a strategy or seek an alternative option. Usually the option they zero in on is sold as ‘guaranteed’ or ‘low risk’ and is nothing of the sort.

After a rotten start to the year some investors were questioning their next move. We had an investor, concerned about the direction of the markets, ask us our view on Nant Whiskey’s offer of a 9.55% return per annum on two barrels of whiskey over four years.

The deal was to put down $25,000 for Nant to hold two barrels of their award winning whiskey in the investor’s name, before they bought it back from the investor for $36,007 in four years.

We didn’t have to look much further than the return to know the investor was somehow the lender of last resort to Nant. Why couldn’t Nant get a bank to give them a loan and specifically at a much better lending rate than 9.55%?

Upon checking Nant’s offer, we found it raised most of our red flags when it came to investment offers.

Uses the word ‘guarantee’ somewhere – check. Uses a celebrity (Matthew Hayden) to spruik their wares – check. Offers a specific return well in excess of anything you’d receive from a bank – check. No Australian Financial Services License (AFSL) when offering what is essentially a financial product – check.

Then media stories started appearing about frustrated Nant investors who were encountering resistance when trying to get their money back.

Our restless investor had their answer.

Meanwhile, a negative quarter on the sharemarket isn’t anything out of the ordinary, nor is it anything to be concerned about. They’ve happened 32% of the time since 1980.

Certainly not enough to drive anyone to invest in drink.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.