Every year S&P Dow Jones put out their yearly SPIVA scorecards and if they sound vaguely familiar it’s because we talk about them every year. We talk about them because they’re important.

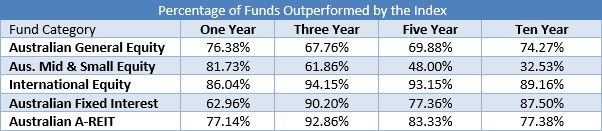

SPIVA reports on the performance of actively managed funds versus their benchmark indices over 1, 3, 5 and 10-year investment periods. And just as in recent years, a significant majority of active funds across Australian equities, International equities, Australian fixed interest and Australian listed real estate failed to outperform their benchmarks.

Now just as a reminder actively managed funds pay fund managers to pick stocks in the hope of outperforming their benchmark. This is opposed to passively managed funds which basically track the index providing a close to benchmark return.

The big issue with actively managed funds, beyond their ongoing inability to outperform their benchmark, is the hefty fees they charge to underperform. S&P wouldn’t be running these yearly performance comparisons if most actively managed funds were beating their benchmarks.

In that instance the actively managed funds would likely form an industry group and produce these reports themselves – then they’d be screaming in the media about how well they perform. At least then they could justify charging their fees with impunity!

But active managers are very quiet when these results come out.

And here’s why:

The message is again clear – active managers are very average at the thing they’re employed for. In four out of the five asset classes surveyed more than three quarters of active fund managers failed to beat their benchmarks in 2016.

And note the particularly bad performance by active international managers over every time period.

Remember, these people are “the professionals”. They spend their days pouring over data and reports, meeting company management and second guessing the next growth sector. This is all done to select the right stocks to include in their funds while excluding the wrong ones.

It’s not working and it hasn’t worked for some time. However, it is important to acknowledge some funds do outperform their benchmarks – who are they? Well, it’s irrelevant because you only find out about them from looking in your rear-view mirror. With those gains already booked, there’s no guarantee they will recreate their outperformance in the future.

We’ll use the example of a well-known Australian active fund manager who shall remain nameless. With an international focus, they have been beating their benchmark with their unhedged Global Fund. So it might seem like they know what they’re doing, unfortunately their most recent 1 year return was more than 6.5% lower than that benchmark.

Today’s rooster is often tomorrow’s feather duster when it comes to share picking.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.