Has the Nant Whiskey investment debacle got you wondering about how an investor gets themselves involved in such a mess? We’ve got a few pointers specific to Nant, but they could very well conspire at any time with any ‘investment opportunity’.

One of the first reasons is investment frustration. Markets are unpredictable and their behaviour can test patience. They can go down rapidly in short spaces of time. They can go up rapidly in short spaces of time. They can also go nowhere for long periods of time.

From 2010 to 2013 was one of those go nowhere periods. Rally would be followed by correction and the annualised return was 2.83% for the All Ords. Prior to 2010 investors had been bashed by the financial crisis before being soothed by an almighty recovery rally. Tales of woe still hung in the air. Many predicted it wouldn’t be long and we’d be trading gold dust for bread and dripping because the final and forever share-market crash was coming.

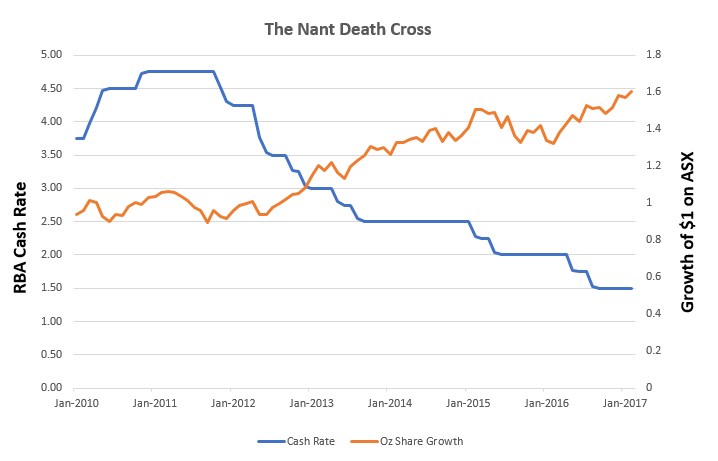

In that period, people were leery about investing while others were bemoaning their lack of returns. As the ASX went nowhere, interest rates peaked before being steadily cut by the RBA.

By the end of 2012 investment returns looked like they were drying up. The ASX remained range bound, while in the space of 14 months, cash returns fell from 4.75% to 3%.

This is what we’ll call ‘The Nant Death Cross’. Three years of lackluster market returns intersected with a falling cash rate. For the frustrated and uneducated investor, this was probably the point where alternate investments start to look good. The latest rally was likely another false dawn because the next crash was surely coming, while their cash was offering diminishing returns.

As the chart shows, anyone with enough patience eventually saw a brighter day and if they had a diversified portfolio that also included international shares, listed real estate and fixed interest, their return was significantly better.

Enter Nant Whiskey and the media. Besides Nant’s advertising, they received a favorable run in the media which helped legitimise the barrel scheme.

The first media mention we could find of Nant’s barrel scheme was on 19 July 2012 in Brisbane’s Courier-Mail, a newspaper where Nant received ongoing favourable coverage after opening a bar in the city. Now deceased business reporter at the paper, James McCullough offered the following:

Batt said Nant would buy the investment back four years later for $7200, representing a compound annual return of 9.5 per cent. Clearly one of the year’s better investment opportunities.

A month earlier the cash rate had fallen to 3.5%. Over the next few years there were ongoing puff pieces about Nant’s bars, their distillery and the barrel scheme in The Hobart Mercury, Sydney’s Daily Telegraph, The Australian, Business Review Weekly (BRW) and on the ABC.

Those that mentioned the barrel scheme inevitably mentioned falling interest rates as a reason investors may consider them. All coverage gave the impression of a business on the rise. So woefully stupid was the BRW piece, that without question, it promoted that Nant could easily borrow from the banks at a cheaper rate, but preferred to open it up to investors because they became friends of the business.

We’ve said it multiple times before, but any company offering an above bank interest rate to investors does so because the banks won’t touch them. Friendship has nothing to do with it.

This is how things turn ugly for investors. Returns fall, they become impatient and they have their head turned by alternatives. Favorable media coverage in the business section does not equal research nor should it legitimise an investment or a company.

The media is never an investor’s friend. They write stories to fill space because nobody pays to read half empty catalogues.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.