Starting a Self-Managed Super Fund is quite an exciting prospect. No longer will an investor be constrained by the shackles of their tired superfund, an SMSF is an open road with untold freedoms ahead, but how to get started on that road? Luckily there are many eager experts out there ready to liberate investors from the boring returns of their banal old super funds and guide them into the riches of buying property within their SMSF.

Let’s say you and your partner are both in your early fifties, have maybe spent 30 years working and have managed to (between both of you) accrue $250,000 in super.

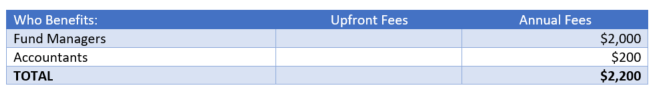

You may be with an industry super fund, maybe retail, maybe you have a financial planner, but for argument’s sake, let’s say the super fund costs are around 1% per annum or less. Let’s say it’s $2,000 to keep the maths easy. You also have an accountant who charges you $200 to do your taxes each year. Your “net worth” so to speak, to the finance industry is $2,200.

But $2,200 doesn’t feed many hungry mouths. It certainly doesn’t contribute significantly to support an assortment of professionals who can help with your SMSF and find you the perfect property. Nor does it contribute to the black hole of state government coffers or pay thousands in interest to keep bank CEOs happy.

To help all these people out, instead of paying your fees annually you could front load most of them and pay them up front so everyone can benefit now rather than having to wait for you to pay fees each year.

This is why it’s such a great idea to set up an SMSF and buy a property right??.

Take that $250,000 from your super funds and set up an SMSF with your partner, you can then buy a brand new $700,000 apartment with a $500,000 loan (allowing $50,000 for stamp duty and expenses).

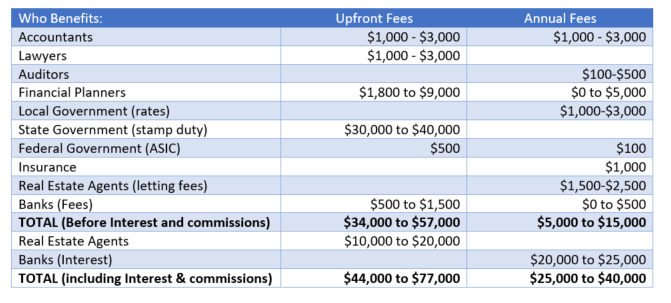

Upfront fees. $1,000 to $3,300 to your accountant. Legals? $1,000 to $3,000. Stamp Duty: $30,000 to $40,000 depending upon the state. Bank Valuation and other fees $500-1,500. Sales commissions are officially paid for by the vendor, not you. But all that means is that the sales commissions on your new apartment are embedded in the price. Add another $10,000 to $30,000.

Plus, now you have an annual $2,000 to $3,000 in accountants’ fees. And at 4.5% investor interest rates you are in for $22,500 in interest payments. You’re probably also now paying a financial planner to sign off on your strategy. At 1% that’s another $2,500.

With gross rental yields around 4%, you get income of $28,000 per year. Then you pay strata, insurance, rates, letting fees etc which means you are probably losing a few thousand each year.

Thankfully negative gearing gets you a discount. Oh. That’s right, an SMSF only pays 15% tax, which means there are almost no negative gearing benefits.

So let’s go through the maths:

Option 1: Leaving your $250,000 in your boring old super fund:

Option 2: Creating an SMSF to buy a $700,000 property:

Sure, you will wipe out close to 25% of your entire (super) savings in upfront fees alone. And your annual fees are at least double what they were, maybe triple. But just look at the list of people who will benefit from your new SMSF: (accountants, lawyers, governments, real estate agents and banks).

That’s a lot of marketing and lobbying power – to convince you to put your super into property via an SMSF, and to lobby the government to keep the changes that allow you to borrow in your SMSF despite ongoing warnings and objections from independent observers.

So you can see now see why setting up an SMSF to buy property is such a great idea!!

Well maybe not for you, but for everyone else in the game it makes perfect sense! (yeah baby!)

Note: this scenario highlights the associated issues related to off the plan property spruiking. For some investors there certainly are legitimate reasons to hold property within an SMSF. The moral of the story – ensure the strategy you take is the right one for your needs and comes with appropriate advice! source: macrobusiness.com.au