The smooth journey. The sea is calm. The air without turbulence. The road is freshly paved. For many of us, there is a constant in life. We want our journeys to be smooth and we want to get where we are going with the least number of bumps, jumps, and sore rumps.

As much as the smooth journey is desirable for many of us when traveling, it’s an absolute imperative for some of us when investing. Anything other than placing our money on a smooth, ever-upward-moving escalator is intolerable. Unfortunately, that’s not real life. Public markets, where companies and bonds are traded daily, mean daily movements in the price of assets. Volatility.

Some say volatility is risk and vice versa. Others disagree. It’s not a debate we’re interested in. Volatility can be a measure of risk, but not the only measure of risk. On public markets, volatility is the price of admission when aiming for a higher expected return. Stocks will be more volatile than bonds. Small companies will be more volatile than large companies. In these cases, the investor is taking a higher risk with the expectation (but not a guarantee) of a higher return.

Despite the link between risk and return, investors continue to hunt the mythical low-risk/high-return asset, generally in private markets. Here the volatility is disguised by infrequent valuations. These valuations aren’t done by the market, but by valuation reports. The asset values don’t gyrate as they do for similar assets in listed markets. Just because you can’t see volatility doesn’t mean less risk, but this lack of volatility has sometimes been trumpeted by asset managers as achieving higher returns with lower risk.

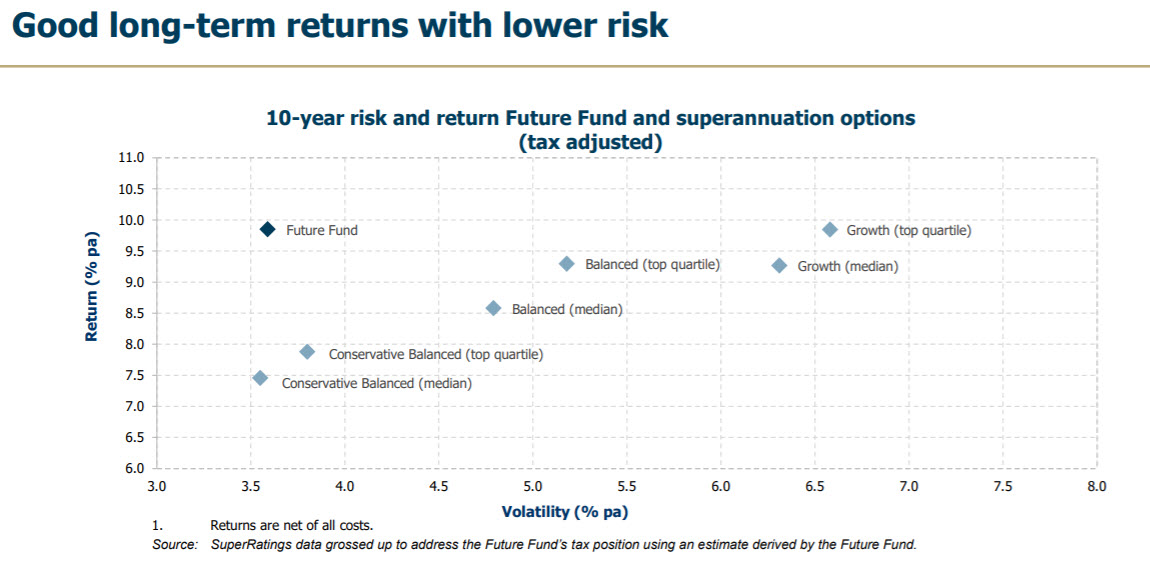

There was a particularly egregious example of this a couple of years back by Australia’s sovereign wealth fund, the Future Fund.

At the time, the Future Fund had over 75% of the fund in growth assets, and over 30% of its capital in unlisted assets revalued on an annual basis. It claimed it achieved its very good results by taking the same amount of risk as a much more conservative portfolio. The Future Fund suggested this because they wanted to present volatility as the only measure of risk. They did so because with over 30% of their assets revalued only once a year, their volatility would be much lower than comparable funds with a higher level of assets valued by the market daily. It’s nonsense.

US investment manager, Cliff Asness, has come up with an ingenious term for this practice: volatility laundering. Hiding volatility with infrequent valuations, that sometimes don’t reflect the valuations in similar assets trading on public markets, while claiming superior returns have been achieved with less risk. It’s akin to marking your own homework, and giving yourself an A, while everyone gets a D from the teacher and you boasting you didn’t have to study!

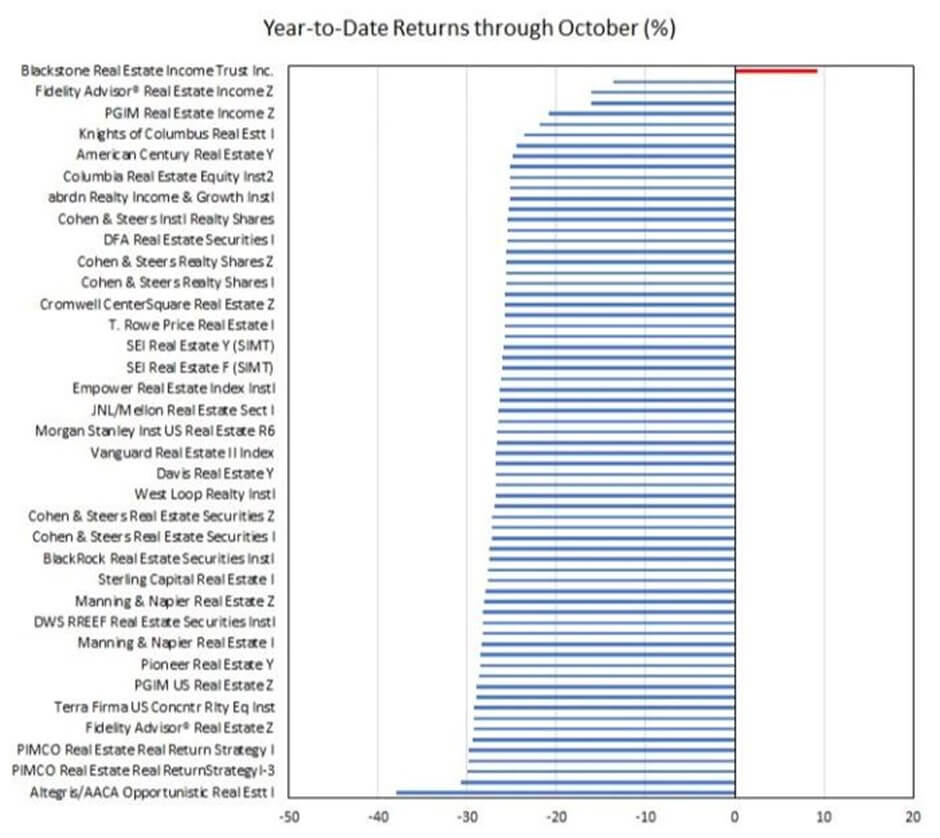

This usually becomes an issue when markets are down, and with markets being in the red last year, the mismatch between public and private valuations has come into focus. There are questions over private equity, private credit, infrastructure, and real estate valuations. Blackstone, a large private equity investment firm, had to limit redemptions on their Real Estate Income Trust when too many investors started pulling money.

If you look at the chart below, you’ll notice something. It’s a comparison of Blackstone’s privately valued fund against a significant number of publicly traded peer funds in the US last year. Blackstone’s fund was the only one in positive territory by October, while every other real estate fund was down by double digits. The fund is revalued monthly and processes redemptions monthly.

While this privately marked outperformance was good for a while, investors began to notice. It’s said a high level of redemptions were coming from Asia, where some investors were forced to exit and cover other losses. However, in an environment where interest rates are going up, and a privately valued real estate fund has markedly better performance than its publicly traded peers, you would have to assume many investors also thought about exiting at a potentially inflated price before any downward revaluations.

In that instance, those investors who realise valuations aren’t where they should be, get to leave at the inflated price, and those still in the fund are left to suffer the write-downs when valuations catch up. Timely valuations are also important when buying. No investor would want to overpay for an asset. If a similar company or asset has dropped 30% in public markets and a fund is struggling with liquidity and needs to sell, no one will give that fund the inflated valuation they’ve given the company or asset.

The question is, how much will valuations catch up across these private assets? Probably not as much as any panicked investors fear. Those valuing their companies and assets will always argue they’re holding different assets and it’s their expertise that led them to select the absolute best performers. If things are really bad, sure there will be some sharp downward revaluations, but otherwise, valuations will likely be “managed” downward to a palatable valuation while arguing they took less risk.

This is an ongoing issue in Australia’s superannuation sector where some funds have been using privately listed investments to “smooth out” returns. Anyone can visit the websites of the various super funds that allocate to unlisted assets and see what goes on. Pull up their unit pricing for sectors like real estate or infrastructure and their values levitate when charted against the falls seen in similar listed assets.

Earlier last year the Australian Prudential Regulation Authority wrote to super fund trustees highlighting the need for “considerable improvement in industry approaches to valuations and the need to conduct valuations proactively and regularly”. APRA intends to offer more guidance in their revised prudential practice guide this year.

Why is it preferable to smooth out valuations rather than have them determined by the big bad public market? If assets have the edge taken off their bad years and their volatility is laundered away, the quicker they can grow without having to recover losses. In the simplest possible terms, it is somewhat like a journey. The less you’re forced to pull over for toilet breaks, get diverted by roadworks, or stop because a pothole blew out a tyre, the quicker you get where you’re going.

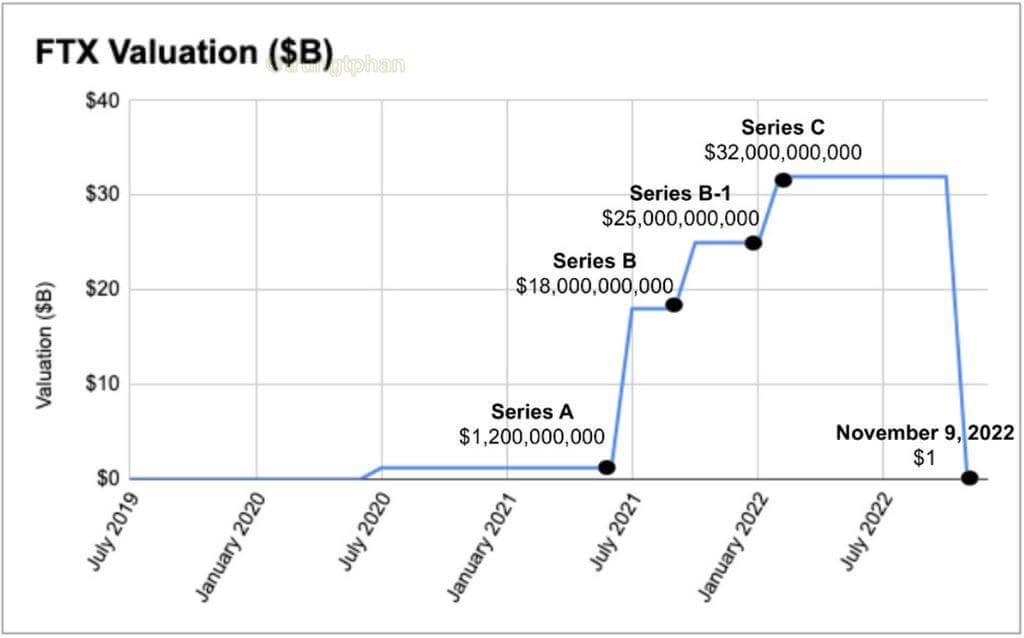

Getting where you’re going without hiccups is not a reality, there are always issues that arise. The claims of “taking less risk” should be policed more rigorously. It needs to be highlighted that unlisted assets have risks, and the risks associated with unlisted assets produce constipated volatility. It builds up without any release. When the laxative of truly bad news arrives, the revaluations occur very suddenly. As shown by what occurred with FTX recently.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancia