John D. Rockefeller once said “Do you know the only thing that gives me pleasure? It’s to see my dividends coming in”. Rockefeller was once the richest man in the world, and according to some, the richest man who ever lived. Hopefully, dividends being his only source of pleasure wasn’t a commentary on how happy the rest of his life was, but most investors would agree there is a pleasure in seeing their dividends coming in.

In times of trouble, the pleasure of seeing dividends coming in would be multiplied for many investors. In recent years we’ve seen some trouble, and we’re repeatedly told something darker is just around the corner. Whether Australia or anywhere else slides into recession, who knows? As no one can see the future we’ll just have to wait and see what emerges.

However, talk of trouble is generally followed by talk of how investors should reposition their portfolios. The sensible thing, as we’ll always argue, is change nothing. Have a portfolio that aims to grow and protect on the downside. If an investor isn’t prepared for all weather, they’ll be permanently fiddling with every predicted change of the wind.

All manner of defensive strategies will be suggested in the media, often pushed by fund managers given column space to talk up a product they have their fingers in. Adding more bonds, focusing on low volatility stocks, some cash-type products. Most of these things are just cyclical churning through ideas, attempting to catch investors or advisers who’ve not settled on a strategy. These people will forever pinball around products depending on the conditions.

Another suggestion that comes up is an increased focus on dividends. The investor should increase their holdings in higher dividend payers or simply change their focus to be a dividend investor. The belief is no matter the conditions, the dividends will remain reliable, roll in on a quarterly basis and there’s not much else to worry about. That attraction is understandable, but it’s a lot to do with feelings.

It certainly feels nice that someone sends you money on a quarterly basis for holding an asset. In contrast, pressing the sell button to realise the same amount of money from an asset feels different like you’re losing some of your assets. Cash inevitably must come from somewhere. It’s not a gift from the heavens. Share prices are influenced by expected future cash flows to shareholders. If cash goes out the door as a dividend, share price and market cap generally fall ex-dividend.

The issue with the dividend game in Australia? It’s not something that has to be sought out. The ASX has a bias towards dividends, due to the top end of the market all being significant dividend payers. It’s something an investor will be a participant in, just by virtue of holding any of the common market index funds or having a large cap fund in their portfolio. Many investors start with large-cap companies in Australia (and globally) as the core of the portfolio, and in Australia, they aren’t missing out on dividends.

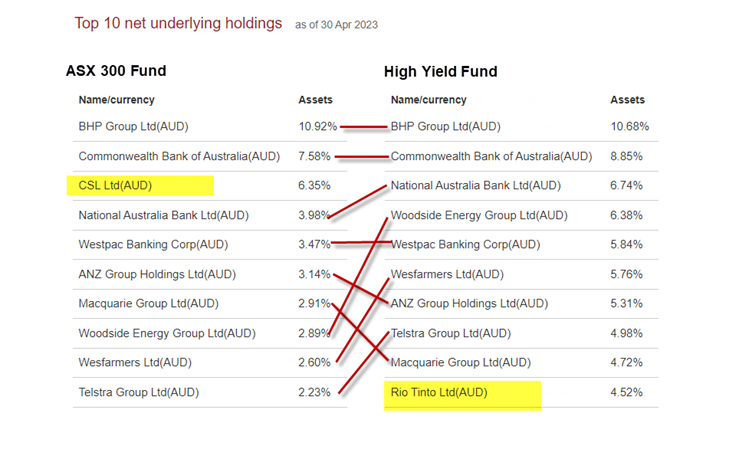

As an example, the following table shows a comparison of the top 10 holdings of an ASX 300 index fund against a high-yield fund. There is less concentration in the top 10, but nine out of the ten companies in the top ten of the ASX 300 sit in the top ten of the high-yield fund. The difference being the lower-yielding CSL swapped out for the higher-yielding Rio Tinto.

Pursuing yield will likely give a little bit extra income, and yes, an increase in franking credits, but there are always trade-offs. Not only does it cost a little more, as a high-yield fund will inevitably have higher fees, an investor will be much less diversified. The ASX 300 option has 302 companies, while the high yield option in the example currently only has 72.

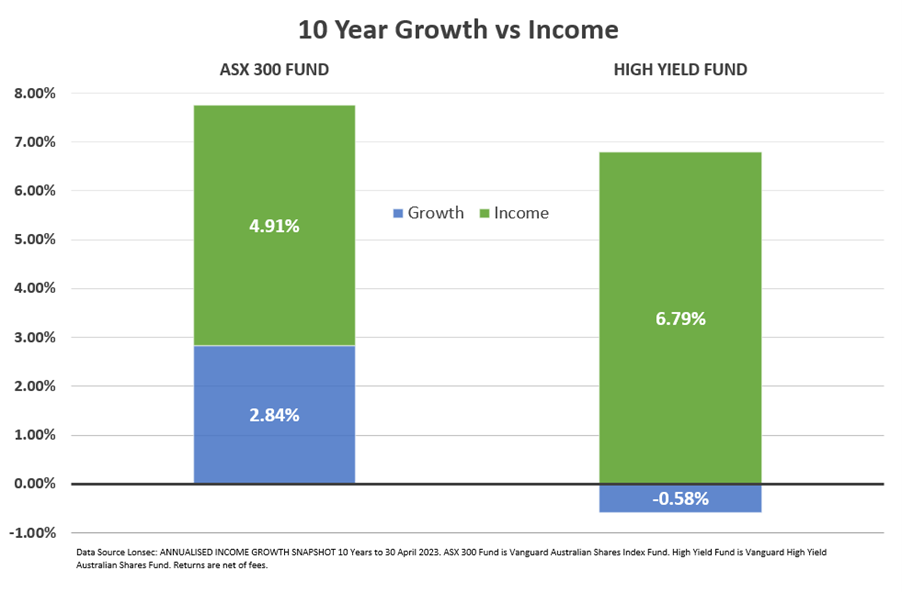

There will also potentially be less growth. As people devoid of facts will often scream “The ASX has gone nowhere since the GFC!” Not quite true. On a price basis, if dividends are excluded it is slightly above where it was in 2008, but total return always means including dividends and growth for a full picture. In the case of a high-yield fund, there’s likely to be less growth because tomorrow’s growth winners are unlikely to be found in a high-yield fund.

Here’s a comparison of both the growth and income returns from each option over the past decade. While the income is higher with the high-yield focused fund, the total return of growth and income with the ASX 300 option has been the winner.

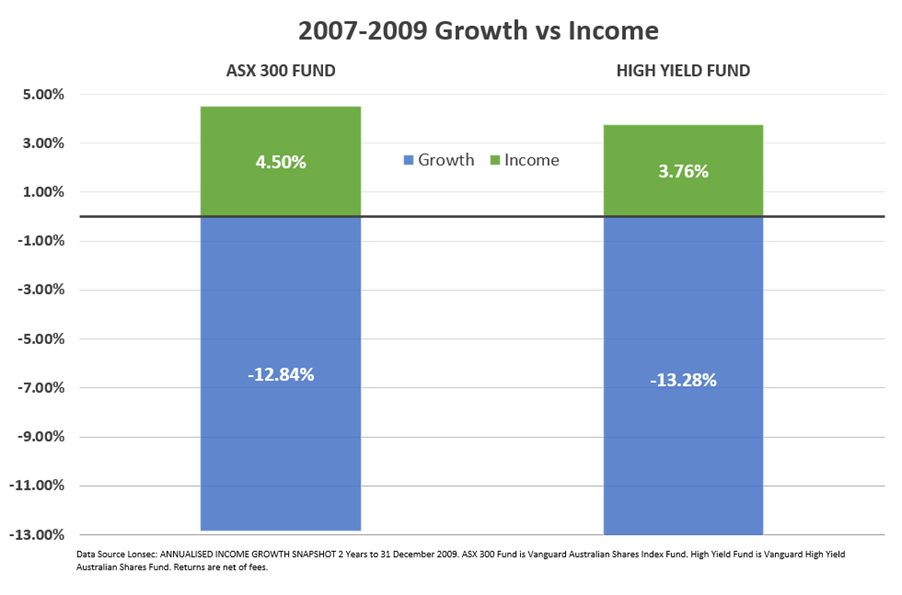

The final thing to note, dividends aren’t guaranteed. Especially in bad times. If an investor is going to concentrate their money into narrower and narrower areas, there is the potential for surprises. There is often a complacency risk that comes with dividend income. Think back to the franking credit debate, anytime a favoured blue chip has fallen on hard times, or during Covid when dividends were cut. All these things have had investors shaking their fists and screaming blue murder. They expected money to be showered on them in perpetuity. When it doesn’t happen, or it’s even hinted their dividend stream might be affected, these investors blame everything but their own investment choices!

High yield doesn’t necessarily equal a guaranteed yield. The income derived from the potential of 300 companies may be more resilient than the income from around 60 or 70 during times of trouble. As this chart highlights, the income from the high-yield fund was lower than that of the ASX 300 during the two-year period across the GFC. Frustrating if an investor expected dividends to be their saviour during times of trouble.

Investors need not avoid dividends or focus on them specifically. Dividends are simply part of the market we invest in; we’re going to get our cut regardless. Mr Rockefeller was right in saying that dividends are a pleasure, but there’s no need to make them our only source of pleasure when investing.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancia