From 1 January 2017 changes are coming to pension payments. Anyone who is currently receiving a pension or part-pension needs to be fully aware of these changes that are based around assessments of asset limits. The changes will mean some pensioners will see a reduction in their payments, while others will see increases in their payments.

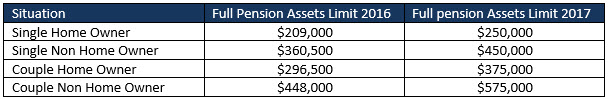

Full Pensions

On the lower end of the scale there will be a number of pensioners who will be better off under the government’s changes and now receive the full pension.

Full pension, home owners If you own a home, the new assets thresholds will allow you to hold assessable assets up to $250,000 (singles) and $375,000 (couples) without impacting your full-pension entitlements. Some single homeowners under the threshold will see about $30 a week added to their pension, while couple homeowners under the threshold will see around $19 each, per week, added to their pensions.

Full pension, non-home owners The new assets thresholds for those who don’t own a home will be $450,000 (singles) and $575,000 (couples) without impacting full-pension entitlements. Some single non homeowners under the new threshold will see around $27 per week added to their pensions, while couple non homeowners included in the new threshold will see between $18-37 each, per week, added to their pensions.

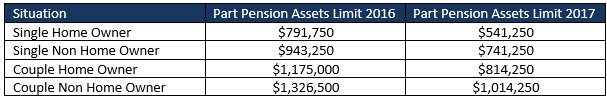

Part Pensions

From 1 January 2017, around 90,000 part-pensioners will lose their Age Pension and about 235,000 part-pensioners’ payments will be reduced.

Part pension, home owners Single homeowners will stop receiving the pension when they have more than $541,250 in assets, this is down from $791,750. Homeowner couples will now longer receive the pension when their assets reach $814,250 in value, this is down from $1,175,000.

Part pension, non-home owners Single non homeowners will no longer qualify for the pension if their assets total $741,250, down from $943,250. And couple non homeowners will no longer qualify after they’ve accumulated more than $1,014,250 in assets, down from $1,326,500.

There is some silver lining for those who have lost their pension in 2017. They will automatically be entitled to receive a Commonwealth senior’s health card or a low income health card. These cards will provide access to Medicare bulk billing and less expensive pharmaceuticals.

If you believe you will be affected by these changes it’s important to plan for them now, rather than waiting to see after January 1. In the coming weeks we’ll look at some strategies and the impact on those affected.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.