The dangers of basing investment strategies on media forecasts were highlighted dramatically in 2016 as the outcome of major world events and the market reaction to them confounded pundits.

The major news event was Donald Trump’s US presidential election win. The Republican outsider defeated Democrat Hilary Clinton on a platform that tapped into voter anger at “insider” politics and the effects of globalisation.

Similar sentiments also fuelled the mid-year vote by Britons to leave the European Union, again a largely unheralded result that led to the resignation of Conservative Prime Minister David Cameron.

Despite these potentially destabilising events, equity markets rallied through the second half of the year – the UK FTSE-100 index reaching record highs in October and the major US indices hitting a succession of historic highs later in the year. This was a stark contrast from January & February when the focus was on China’s economy and bottom dwelling oil and commodity prices.

The steady US economic recovery, falling jobless rate and uncertainty over the Trump administration’s policies were cited by the US Federal Reserve in December when it raised its benchmark interest rate after a year-long pause.

GDP growth in China, meanwhile, hit a 25-year low of 6.7%. The government supported the economy with spending on infrastructure, though international bodies such as the IMF and OECD expressed concern at rising levels of debt.

Growth in the EU area also remained subdued, despite continuing accommodative monetary policy. The European Central Bank expressed concern about potential knock-on effects of Brexit to the EU and of the Trump presidency to populist movements in Europe.

In Australia, the hangover from the end of the mining investment boom lingered. In only the fourth such occurrence since the 1991 recession GDP shrank in the September quarter as businesses, consumers and government all cut spending.

The RBA cut interest rates twice in 2016, but also expressed concern at the effect of low rates on housing prices and household debt. Banks were urged to strengthen lending standards.

Market Overview

Asset Class Returns

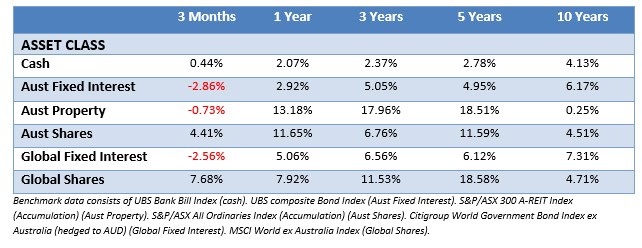

The following outlines the returns across the various asset classes to the 31th December 2016.

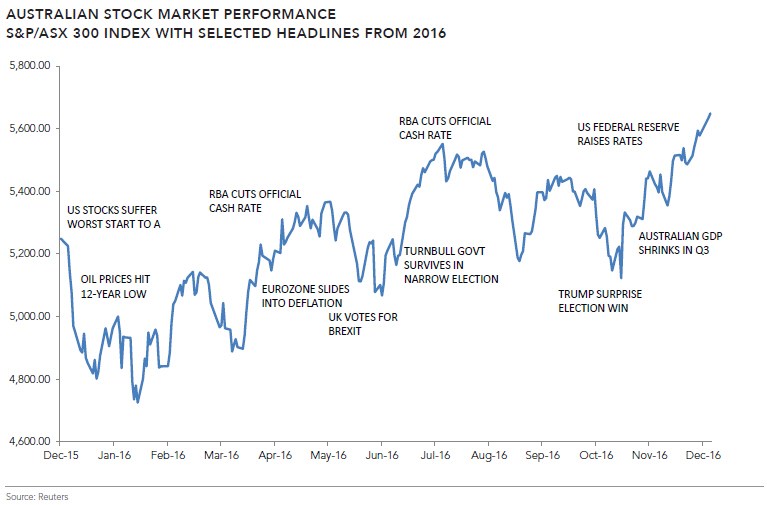

After the January rout, share market sentiment began to shift from mid-February and bar a brief sell-off after the UK vote in late June, the overall trend was higher. Global GDP growth slowly picked up, while commodities bounced as supply eased and investment pulled back.

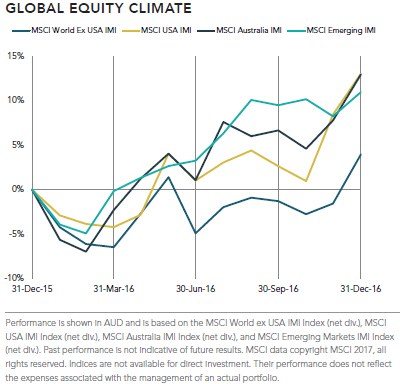

Internationally, the US equity market was one of the best performers over the year, alongside those of commodity producing economies such as Canada and Norway. Energy and materials sectors were among the top gainers.

A similar pattern was evident in emerging markets, with energy and materials topping annual sector tables and commodity producers such as Russia (oil) and Brazil (iron ore) the best performing countries. India and China were largely flat over the year.

Locally, the Australian and New Zealand share markets were among the best performers in the developed world. The Australian market rose by nearly 12%, led by resource stocks. The NZ market hit record highs in August, before retracing, though ended up nearly 9% over the year, its seventh annual gain in eight years.

Value stocks were strong performers on the Australian market, while there was a more modest premium from small cap stocks over the year. Australian and international fixed interest finished stronger over the year, although both were punished in the final quarter as US Treasuries sold off after the Trump victory.

THE YEAR IN NEWS

The chart below highlights some of the year’s major news events in context of broad Australian market performance. These headlines are not offered to explain market returns but to show that investors should view daily events from a longer-term perspective and avoid making investment decisions based solely on the news.

The performance of markets in 2016 underscored once again the dangers of basing one’s investment strategy on the news cycle or of acting on opinions and forecasts of media and market pundits. It also highlighted the importance of investors diversifying across different assets and different countries, while staying disciplined within the plan designed for them.

The Australian’s Top Picks

Every December The Australian newspaper has an end of year feature offering its top 100 financial picks for the year ahead. They generally comprise shares, managed funds, mortgages, credit cards and other financial products.

For the past three years, we’ve followed the share picking section of the list with interest – knowing that for the most part, while they will have some success, share pickers usually fail to beat the market, especially over the long term.

In 2013 The Australian’s 66 share picks offered 31 winners and 35 losers, they combined to provide a 8.86% loss. The wider ASX (price only) returned 14.76%.

In 2014 The Australian’s 65 share picks offered 22 winners and 42 losers and 1 neutral return, they combined to provide an 8.21% loss. The wider ASX (po) returned 0.66%

In 2015 The Australian’s 53 offered 20 winners and 33 losers, however they combined to provide a 13% return – an anomaly that came down to the 724% return of Bellamy’s Organic. We know how that winner eventually turned out – one of the bigger disasters of 2016. The wider ASX (po) returned a 0.82% loss.

In 2016 The Australian hit one out of the park – 35 winners and 25 losers for an overall return of 20.67% against the wider ASX (po) return of 7.01%.

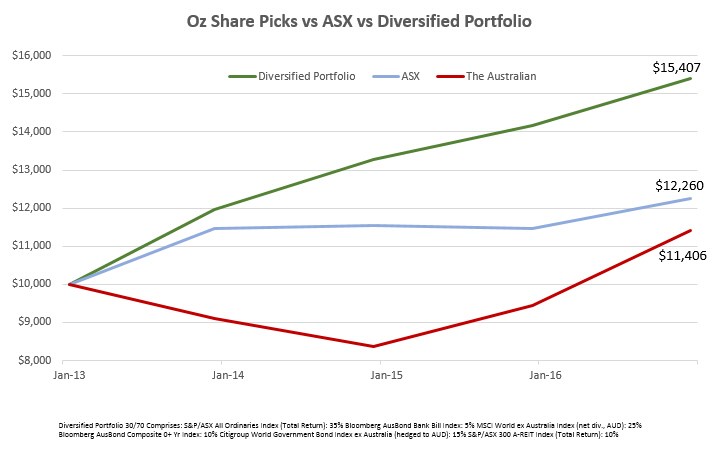

On the surface the share pickers vs the market now looks to be a 50/50 proposition after four years, even if The Australian’s losers outnumber the winners, but if we compare the full returns across those 4 years it becomes a different story.

The ASX (po) has an average annual return of 5.40% against the 4.15% from The Australian’s picks. And if you started with $10,000, the market would be on $12,260 vs $11,406 for The Australian.

But while picking shares is a common thing, few people invest solely in the ASX index. They do invest in diversified portfolios though. Adding an actual portfolio into the mix makes this comparison more realistic.

In this instance, we’ll add a portfolio with 70% growth assets (local, international shares and listed real estate) and 30% defensive assets (local, international fixed interest and cash).

As you can see the difference is stark. A diversified portfolio has delivered an 11.52% annual return since 2013 and grown to $15,407. The Australian trails both the portfolio and the ASX. Not only is the portfolio more diversified, it’s enjoyed the benefits of higher returns from international shares, fixed interest and listed real estate to improve its return.

While we’re happy to congratulate The Australian on their past two years, their outperformance can be attributed to one company’s performance in 2015 and two companies in 2016. Does that sound like good judgement or good luck?

The diversified portfolio’s return can be attributed to thousands of companies, bond funds and real estate trusts spread throughout many of the world’s economies.

What would you rather be relying on?