It happens maybe once or twice a month. A call comes into our office with someone wanting to speak to an adviser. They’re not an existing client, nor are they known to us, but they want to talk about investing. It’s always something specific, maybe real estate or gold.

The reason it’s always something specific is because the person interested in investing has already made up their mind about what they want to invest in. The reason they want to speak to an adviser is to seek some external validation on their decision. If the adviser agrees with them, they’ll look for help in implementing their plan.

The phone call generally ends in disappointment. The adviser wishes them the best and hopes they don’t blow themselves up. The investor likely then rings up someone else in hope of finding the confirmation bias they’re seeking. That will be someone in the business of selling whatever they want to invest in. Much less about the advice, much more about a commission.

We don’t know the rationale behind the phone calls, but we suspect it’s the fear of missing out syndrome. Investors are known to become interested in an asset after it has increased in value. When an asset class goes up in value, it gets significantly more attention in the media and the investor feel they have to buy in before it goes up any further.

Pumping the brakes should be the action of any investor who has this feeling.

They then should ask themselves a few questions.

What assumptions am I making?

What factors could change to make these assumptions either exceed/or fall short of their expected return?

Have I actively sought out a contrary opinion?

What is the basis of the contrary opinion?

Do I still disagree? Why?

There are plenty of reasons why we don’t recommend individual shares, physical real estate or gold. Primarily because of the concentration risk – too much capital is tied up in one specific asset and that capital becomes subject of the fortunes of that one specific asset. That leads to a massive increase in risk.

For the individual share, it’s generally tied to one country and involved in one industry. An industry downturn will inevitably hit it hard. For physical property, it’s much the same. It’s concreted to one location and subject to the fortunes of that location. For every Sydney there’s a Perth, and for every booming Melbourne suburb there’s an apartment tower down the road where every investor is underwater on their loan.

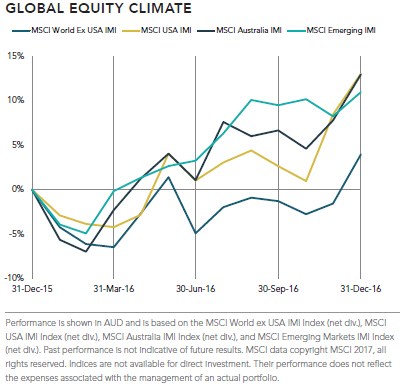

In contrast, it’s why we look to spread risk and diversify across asset classes and countries. And this is where we admit we do have a bias – it’s believing in capitalism and that functioning economies around the world will provide growth to reward investors.

It’s still the best risk/reward scenario we’ve found, but again, we’re biased by the facts.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.