The delayed and momentous 2020 Federal budget has been handed down. It contains some amazing figures. The normally fiscally conscious Liberal Nationals have turned spendthrifts in a bid to lift the country out of the COVID-19 induced recession.

It wouldn’t be a budget without heroic assumptions and the biggest in this budget is the assumption there will be a COVID vaccine next year, along with the majority of Australians being vaccinated. It also assumes growth will be running at 4.25% and unemployment will be down to 6.5 percent by the end of 2022.

Another big assumption: everyone will run out and spend. The consumer and business, that’s what the government wants.

Notably, there doesn’t seem much additional infrastructure spending which one might assume would be the cornerstone of a budget attempting to lift a country out of recession. Here the hope is tax cuts, business asset write-offs and hiring incentives will do the heavy lifting. While the over-relied upon golden goose of population growth has disappeared. As Australia has been propping up growth by way of immigration for some time, how the economy performs without it will be interesting.

What we have is a budget deficit of $213 billion, a likely decade of deficits and national debt passing $1 trillion.

That’s the grim stuff, onto the good stuff, and what it means for your bank account.

As always to ensure you make the most of your money, your adviser will offer advice on how to best apply it to your circumstances.

Income Tax

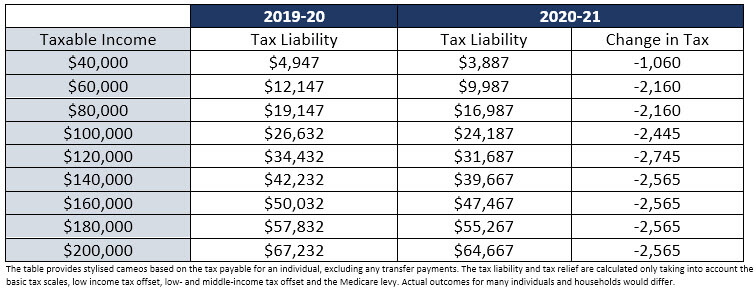

Various thresholds and offsets are changing, with the ‘Stage 2’ legislation from last year’s budget scheduled to occur from 1 July 2022 brought forward and backdated to 1 July 2020. Positively, this leaves 11 million taxpayers with extra disposable income, with more than 7 million Australians receiving tax relief of $2,000 or more this year. We’ll just focus on the outcome overall in the table below. This should mean tax changes are reflected in pay packets sometime later in the year when business payroll systems adjust.

How it looks for this financial year

Social Security Stimulus

Those on Age Pension, Disability Support Pension, Carer Payment, Carer Allowance, Family Tax Benefit, or Pension Concession Card Holders, Commonwealth Seniors Health Card holders, and Eligible Veterans Affairs payment recipients and concession cardholders will receive $500 over two $250 cash payments. These will be paid in December 2020 and March 2021. Positively this leaves those on lower payments with some disposable income to be spent.

Superannuation

The ATO will develop systems enabling new employees to nominate a MySuper fund through the YourSuper portal. This will also provide an online comparison tool.

Superannuation members will have their account ‘stapled’ to avoid the continual creation of new accounts when changing employers. By 1 July 2021, if an employee doesn’t nominate an account when starting a new job, employers will pay their super contributions to their existing fund. A person can maintain multiple funds but by choice.

APRA will benchmark MySuper products based on net investment performance. Funds underperforming over two consecutive annual tests will be prohibited from receiving new members until they cease underperforming. This will be extended to non-MySuper products from1 July 2022. Underperforming funds would need to notify members and refer members to the YourSuper comparison tool.

The account stapling is positive and will cut down on money wasted across multiple rats and mice accounts. Hopefully, it will encourage more engagement from investors, with their retirement savings pooled in one account. The benchmarking is dubious, and the short time frame concerning. Investment performance can never be guaranteed, and investors shouldn’t be encouraged to believe it is, especially using short time periods. It will be bad news if the comparison and benchmarking exercise encourages performance chasing and fund hopping from investors.

Granny Flats & Capital Gains Tax

A capital gains tax (CGT) exemption will be applied to granny flat rights that are supported by a formal written agreement. This aims to strengthen the financial and legal security of individuals entering into these arrangements, by removing potentially significant tax consequences associated with formalising these types of agreements.

Seniors & Home Care

The budget increases the number of approved home care packages available over the next four years with 23,000 new packages for older Australians waiting to receive at-home care, at a cost of $1.6bn. A likely response to the interim report of the royal commission finding the government needed to act urgently to reduce waiting times for older Australians seeking in-home support.

Business

As noted, most emphasis has been on business concessions and incentives to hopefully stimulate the economy.

Tax concessions to small businesses with a turnover of up to $50 million will be expanded: From 1 July 2020, eligible businesses would be able to immediately deduct start-up expenses and certain pre-paid expenditure.

Temporary full expensing of capital assets. From 7 October 2020 Businesses with an aggregated turnover of less than $5 billion will be able to deduct the full cost of eligible capital assets acquired from 7 October 2020 and used or installed by 30 June 2022.

Fringe Benefits Tax Exemption. From 1 April 2021, eligible businesses will be exempt from fringe benefits tax (FBT) on car parking and multiple work-related portable electronic devices, phones tablets laptops etc – an ‘eligible business’ will shift from one with turnover less than $10 million to those with turnover less than $50 million. A FBT exemption will be provided to employers providing training and reskilling to redundant or soon to be redundant employees. Ordinarily, FBT would apply if the training provided is not sufficiently connected to the current employment.

The Government will also consult on potential changes for employees undertaking training at their own expense. Currently, a tax deduction is only available where the training relates to the current employment.

Temporary loss carry-back from 1 July 2020. Companies with a turnover of less than $5 billion can carry back losses in each of 2019/20, 2020/21, and 2021/22 tax years against any profits in 2018/19 or later years. The carryback will give rise to cash refunds of tax previously paid.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation, and individual needs. #investing #goals-based advice #investments #retirement #retirement planning #smsf #wealth creation #personal insurance #superannuation #martincossettini #fiduciary financial advisor #bluediamondfinancial