Ever met an intelligent person who could make a mess of various simple tasks? Maybe someone who was incredibly smart, but equally incredibly gullible? It shouldn’t be a surprise, it’s natural that intelligence, awareness or knowledge in one area doesn’t automatically translate to another.

The reality is we all have a circle of competence for various parts of our life and our skills. Once we step beyond the boundaries of our competence we’re less likely to make good decisions and more likely to open ourselves up to making mistakes or being taken advantage of. This can often be due to overconfidence. We assume our competence will naturally extend to other disciplines.

This is true when it comes to investing. Over the past year, we’ve made mention of the Nant Whiskey debacle more than once. Those angry Nant investors profiled in the media have often been successful business owners and professionals who thought they knew a shrewd investment when they saw it. While a guaranteed return of 9.5% should have been a red flag, they clearly thought it was money for jam.

One of the most extreme examples of this is a psychologist called Steven Greenspan who wrote a book called “Annals of Gullibility: Why We Get Duped and How to Avoid It”. The book was released the same month Bernie Madoff’s investment fund was revealed as a ponzi scheme. Why is this relevant? Because Steven Greenspan had invested 30% of his retirement savings in Madoff’s fund!

“Yep, the guy who wrote the book on not getting duped, found himself duped the same month his book on not getting duped came out!”

In the Wall Street Journal a few months later Greenspan admitted his culpability.

In my own case, the decision to invest in the Rye fund reflected both my profound ignorance of finance, and my somewhat lazy unwillingness to remedy that ignorance. To get around my lack of financial knowledge and my lazy cognitive style around finance, I had come up with the heuristic (or mental shorthand) of identifying more financially knowledgeable advisers and trusting in their judgment and recommendations.

Greenspan’s sister and many of her friends were also invested, enjoying solid (but not spectacular) and reliable returns, which added to Greenspan’s belief the fund was a great opportunity. However, one of Greenspan’s financially savvy friends warned him against it. Unfortunately, Greenspan chalked this up to cynicism and ignored the advice.

For her part, Greenspan’s sister admitted she went for what had been predictable returns.

“I suppose it was greed on some level. I could have bought CDs or municipal bonds and played it safer for less returns. The problem today is there doesn’t seem to be a whole lot one can rely on, so you gravitate toward the thing that in your experience has been the safest.”

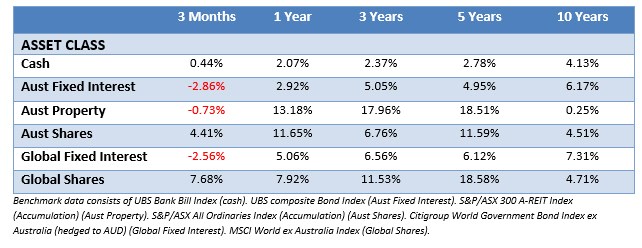

And Madoff’s returns had been consistently safe, something that people who aren’t financially savvy are often desperate for – a decent return with little risk. Something that doesn’t exist.

In fact, Madoff’s monthly performance was so consistent, it looked like the growth of a cash investment due to its stability, except for the fact it turned every $1 invested into $6.75 over 18 years.

In contrast, the S&P 500 turned every $1 invested into $5.71 over the same period with a significantly more volatile and believable path.

Madoff’s fund returns weren’t outlandish, quite often it didn’t outperform the S&P 500 on a yearly basis, but because it eliminated any negative annual return (a massive red flag) it managed to beat the S&P 500 over the longer time-frame.

It was found in the period between 1993 and 2008 Madoff’s fund only had 12 negative months, the worst being a miniscule -0.64%. While in contrast the S&P 500, a normally functioning sharemarket, had 62 negative months.

No one has to be an outright expert, however we can all inform ourselves enough to know whether something is credible or not. The clues are always out there.

Did it really seem possible that Lance Armstrong could come back from near death to win the Tour de France seven times straight? Especially given he only finished the Tour de France once out of his previous four attempts?

That’s somewhat equivalent to Bernie Madoff never having a losing investment year. And when it comes to less than credible investments the clues are always there. Genuine investments always involve risk, they rarely have predictable returns and nothing’s ever guaranteed.

This represents general information only. Before making any financial or investment decisions, we recommend you consult a financial planner to take into account your personal investment objectives, financial situation and individual needs.